Today's Events

Monday, March 2, 2026

Charles Houska: Master of Play

From: Monday, January 12, 2026

Until: Sunday, April 5, 2026

10:00am - 5:00pm

Where:

St Louis, MO @ World of Chess Hall of Fame and Galleries

Posted by Local Resident in Events

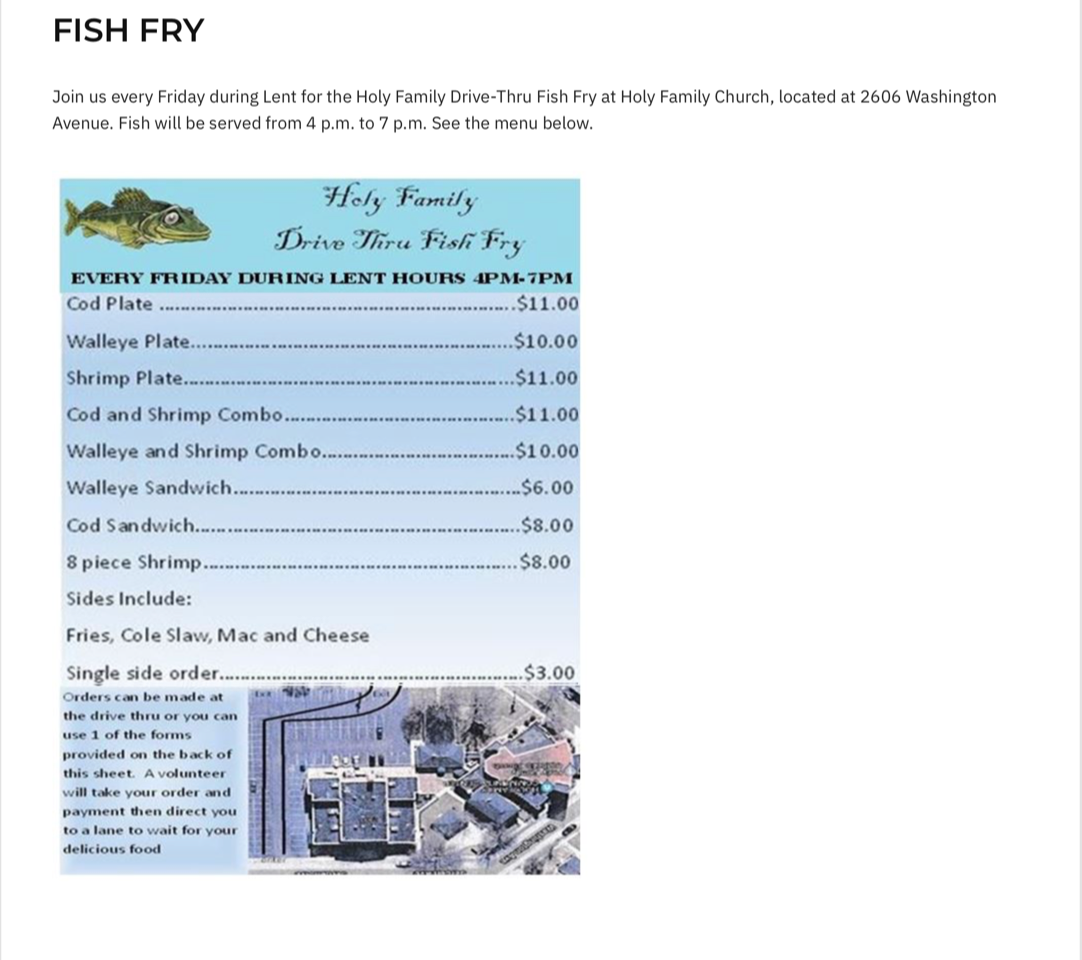

LENTEN Drive-Thru Fish Fry

From: Friday, February 27, 2026

Until: Friday, April 3, 2026

4:00pm - 7:00pm

Where:

Granite City, IL @ Holy Family Catholic Church, 2606 Washington Avenue

Posted by Local Resident in Events

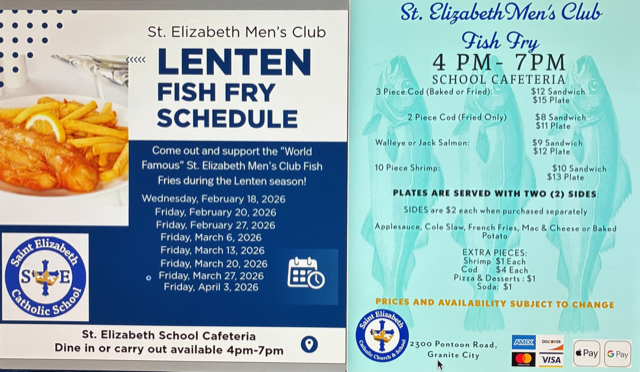

LENTEN Fish Fry

From: Friday, February 27, 2026

Until: Friday, April 3, 2026

4:00pm - 7:00pm

Where:

Granite City, IL @ St. Elizabeth School Cafeteria, 2300 Pontoon Rd

Posted by Local Resident in Events

Mark your calendars! The following events were added to the CityPages recently

Recent Discussion Activity

| Topic | Category | Replies | Views | Last Activity |

|---|---|---|---|---|

|

The Real Estate Elephant in the Room.

by Illinois Only Resident · Illinois Only · Yesterday 5:07pm Verified Business: George Sykes, Managing Broker, Worth Clark Realty |

Specials & Offers | 0 | 192 | Yesterday 5:07pm |

|

New Listing: 2653 Grand Avenue, Granite City, Illinois 62040

by Local Resident · All Communities · Friday 9:25pm Verified Business: George Sykes, Managing Broker, Worth Clark Realty |

Specials & Offers | 0 | 498 | Friday 9:25pm |

|

Satirical Minutes from the Emergency Meeting of the Six Mile Prairie Horseshoe Guild

by Local Resident · All Communities · Wednesday 10:57am |

Funny Stuff & Jokes | 0 | 808 | Wednesday 10:57am |

|

Refuge Announces Former NCAA & NFL Athlete Gaelin Elmore as Guest Speaker for 2026 “Build a Refuge” Fundraising Dinner

by Local Resident · All Communities · Tuesday 11:08am Verified Business: Refuge |

Press Releases | 0 | 750 | Tuesday 11:08am |

|

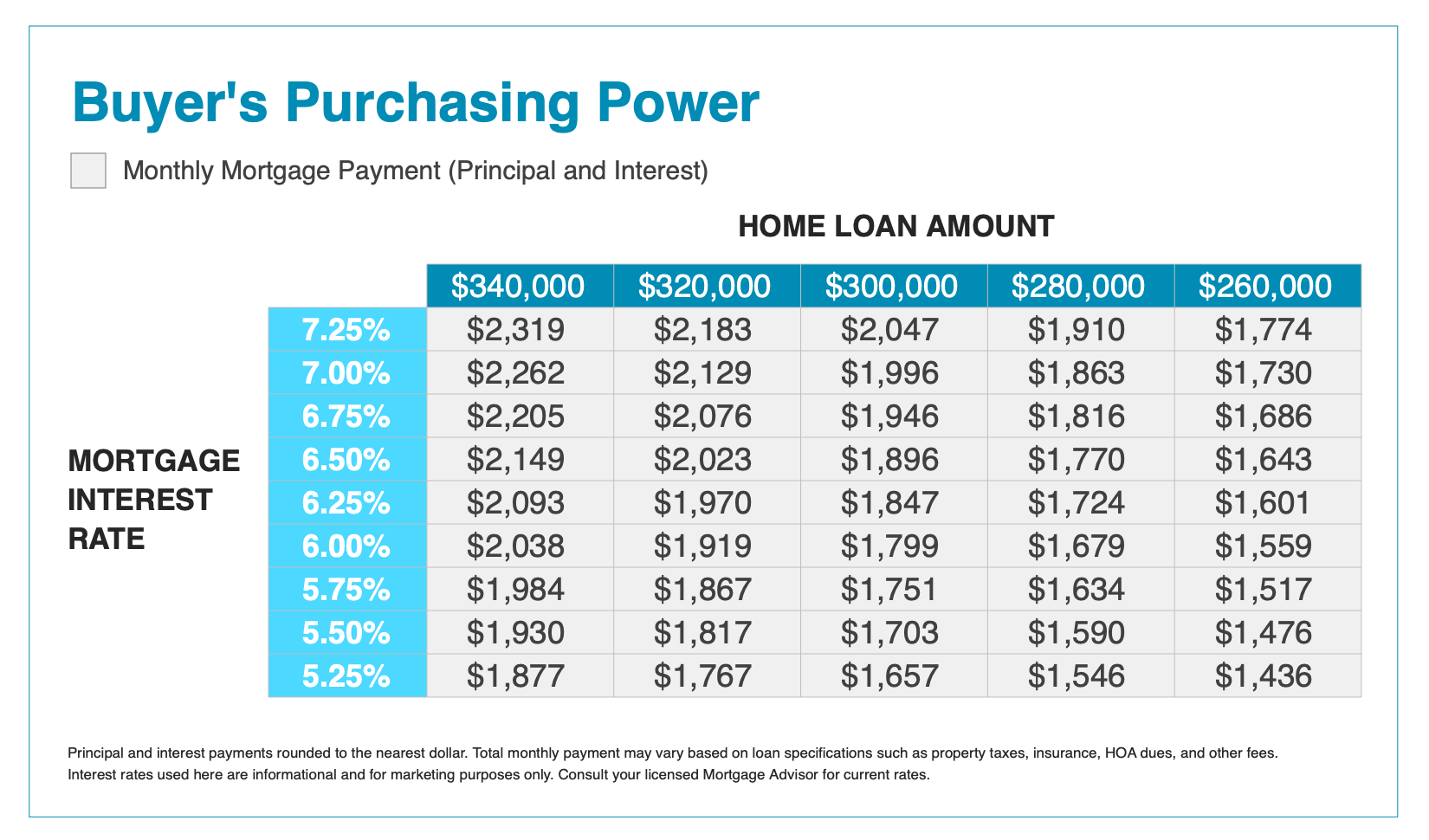

Do interest rates really matter when buying a home?

by Local Resident · All Communities · Feb 18, 2026 10:14am Verified Business: George Sykes, Managing Broker, Worth Clark Realty |

Industry Advice | 0 | 1235 | Feb 18, 2026 10:14am |

|

Grime Stoppers

by Local Resident · All Communities · Feb 10, 2026 2:57pm |

CityPages Announcements | 2 | 1774 | Feb 17, 2026 2:05pm |

|

Granite City Girls Varsity Basketball Move On

by Local Resident · All Communities · Feb 14, 2026 10:08pm |

Sports | 1 | 1393 | Feb 16, 2026 7:51pm |

|

Nano Paradox Multi-Purpose Cleaner for Restaurants

by Local Resident · All Communities · Feb 16, 2026 2:54pm |

CityPages Announcements | 0 | 1527 | Feb 16, 2026 2:54pm |

|

Prescription Eye Glass Donations

by Local Resident · All Communities · Feb 14, 2026 12:40pm |

Free Stuff | 0 | 1348 | Feb 14, 2026 12:40pm |

|

BNI BiG of Edwardsville Earns “Top Dog” Regional Award

by Local Resident · All Communities · Feb 13, 2026 6:43pm Verified Business: BNI BiG |

Press Releases | 1 | 1818 | Feb 13, 2026 7:07pm |

Brokered by: Keller Williams Pinnacle

Brokered by: Keller Williams Pinnacle